Ten days have passed since a glitch rocked the Commercial Bank of Ethiopia, causing significant disruption in Ethiopia’s financial sector. The system error, which occurred on March 15, 2024, allowed users to transfer funds exceeding their account balances and withdraw money from ATMs despite insufficient funds.

The bank’s been tight-lipped about the exact numbers, saying they’re still investigating. But today, President Abe Sano of CBE finally held a press conference to spill the tea.

The President revealed that retrieving the cash withdrawn from ATMs proved challenging, especially since some of the money had already been spent.

As initially alleged, nearly half of the stolen funds were traced back to university students, prompting the bank to even contact their parents for assistance.

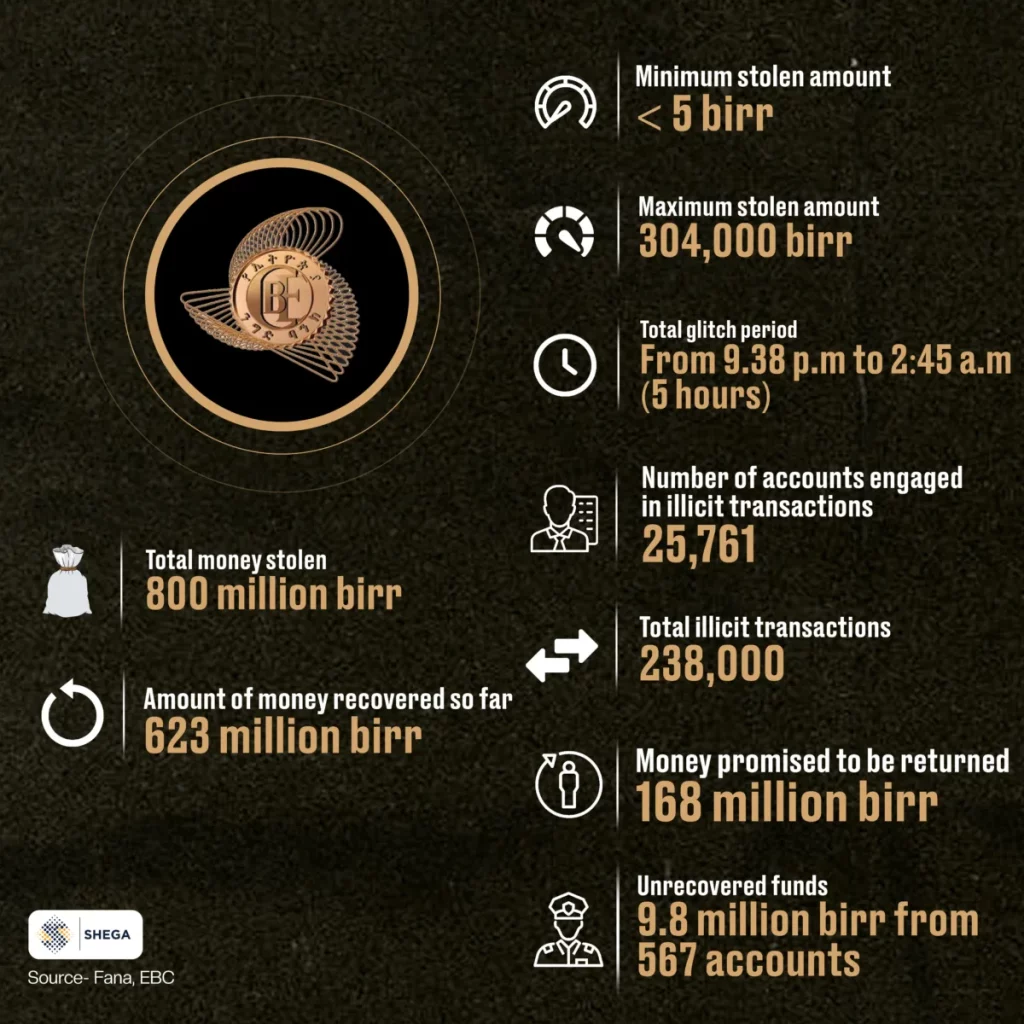

The minimum amount stolen was less than 5 birr, while the maximum amount stolen reached 304,000 birr. The glitch lasted from 9:38 p.m. to 2:45 a.m., totaling 5 hours. In total, the amount stolen amounted to 800 million birr.

The scale of the illicit transactions was large, with 25,761 accounts involved and a total of 238,000 transactions recorded. Despite these challenges, efforts to recover the stolen funds have seen some success. As of the latest update, 623 million birr, representing 78% of the lost funds, have been recovered.

Looking ahead, the bank anticipates further recovery efforts, aiming to recoup an additional 118 million birr. However, challenges remain, with unrecovered funds amounting to 9.8 million birr from 567 accounts as of March 26, 2024.

Additionally, the bank is implementing measures to recover outstanding funds. Lists of customers who have not returned the money, despite the given deadline, have been posted in branches. But the Bank is not stopping there; it is also currently circulating their names on social media platforms and media outlets.

Source: Shega, EBC